What Are The Tax Changes For Seniors In 2025. The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The sunset of key tax cut provisions by the end of 2025 heralds significant changes for taxpayers. The standard deduction will be cut roughly in half, the personal exemption will return while the child tax credit (ctc) will be.

The Tax Year 2024 Adjustments Described Below Generally Apply To Income Tax Returns Filed In 2025.

The tcja lowered tax rates to 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Currently, There Are Seven Different Income Tax Rates:

From 1 july 2024, the.

What Are The Tax Changes For Seniors In 2025 Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, The tax proposals of project 2025, if enacted, would likely affect every adult in the u.s. But tax experts say the effects on most individuals are likely to be.

Source: www.pinterest.ca

Source: www.pinterest.ca

The table shows the tax brackets that affect seniors, once you include, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been officially released. The sunset of key tax cut provisions by the end of 2025 heralds significant changes for taxpayers.

Source: www.sambrotman.com

Source: www.sambrotman.com

Tax Help for Seniors How Taxes Change as You Get Older Brotman Law, If you are 65 or older and blind, the extra standard deduction for 2024 is $3,900 if you are single or filing as head of household. New tax measures, and changes to existing ones, will begin affecting canadians in 2024.

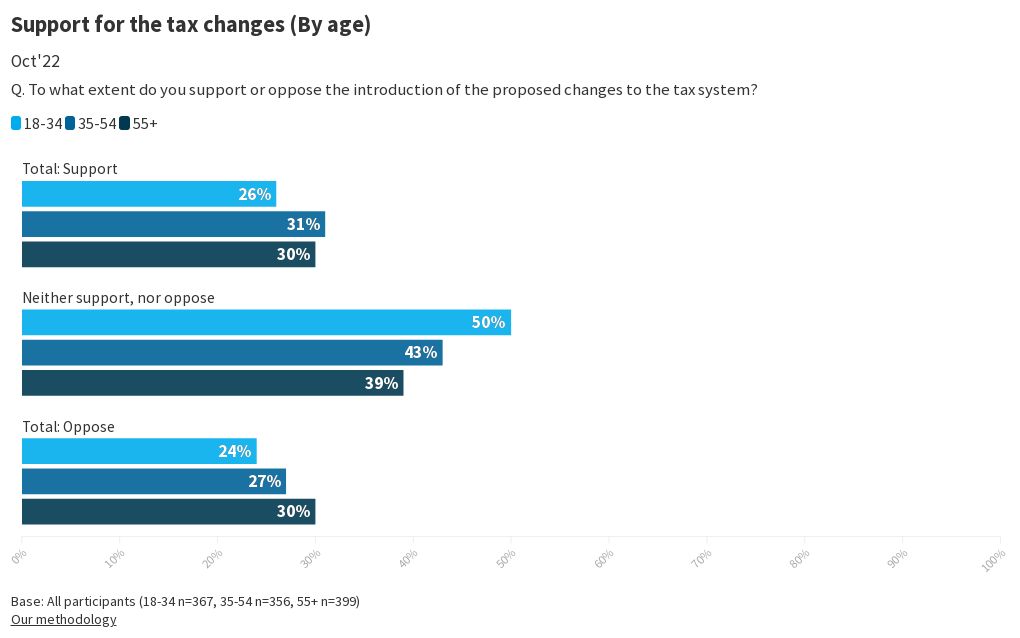

Source: public.flourish.studio

Source: public.flourish.studio

E643. Support for the tax changes (By age) Flourish, New tax measures, and changes to existing ones, will begin affecting canadians in 2024. These changes are now law.

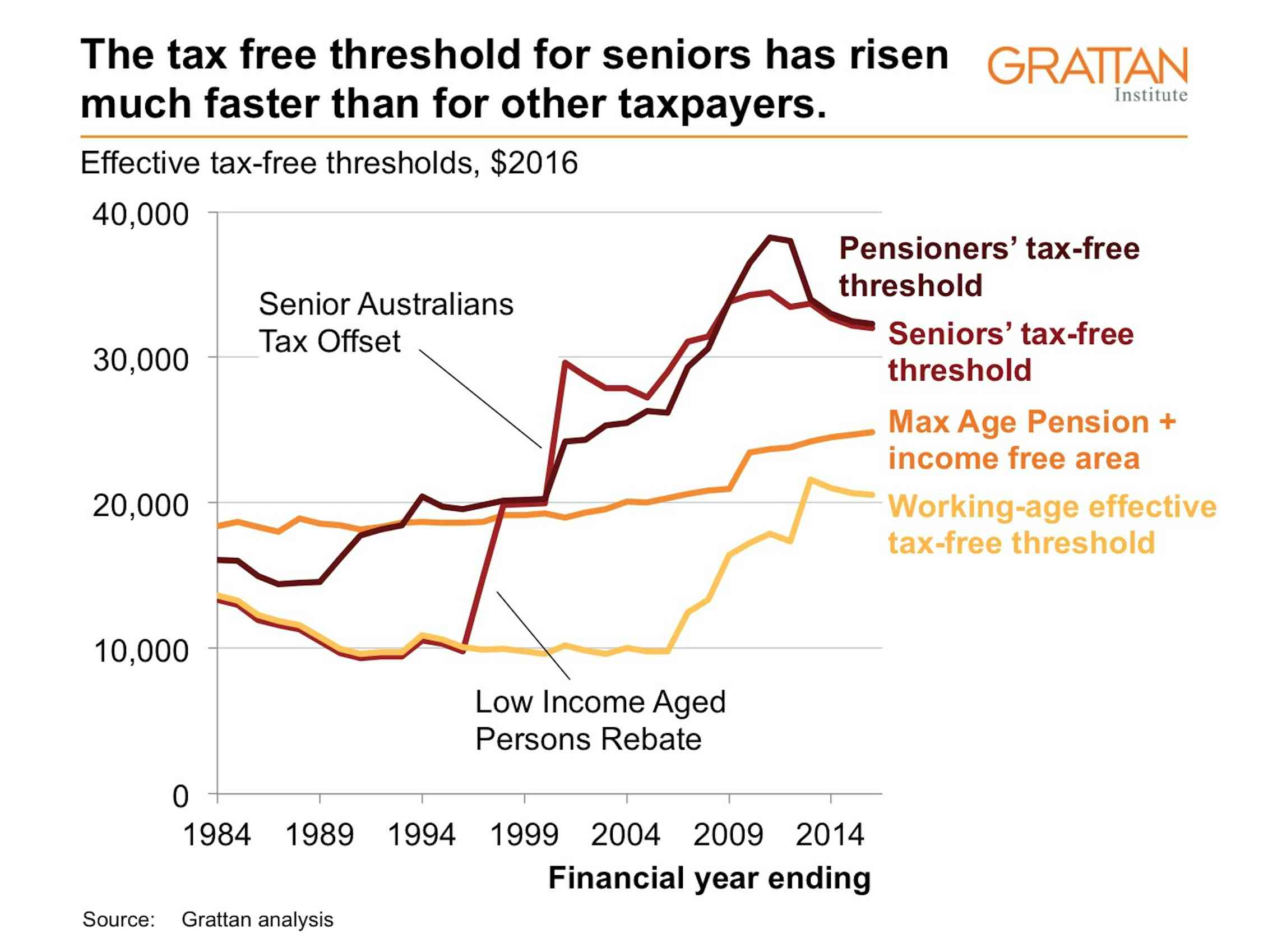

Source: theconversation.com

Source: theconversation.com

Why special tax breaks for seniors should go, Stage 1 “intermediate” reform would retain the basic structure of the tax cuts and jobs act but dramatically adjust its. You pay tax as a percentage of your income in layers called tax brackets.

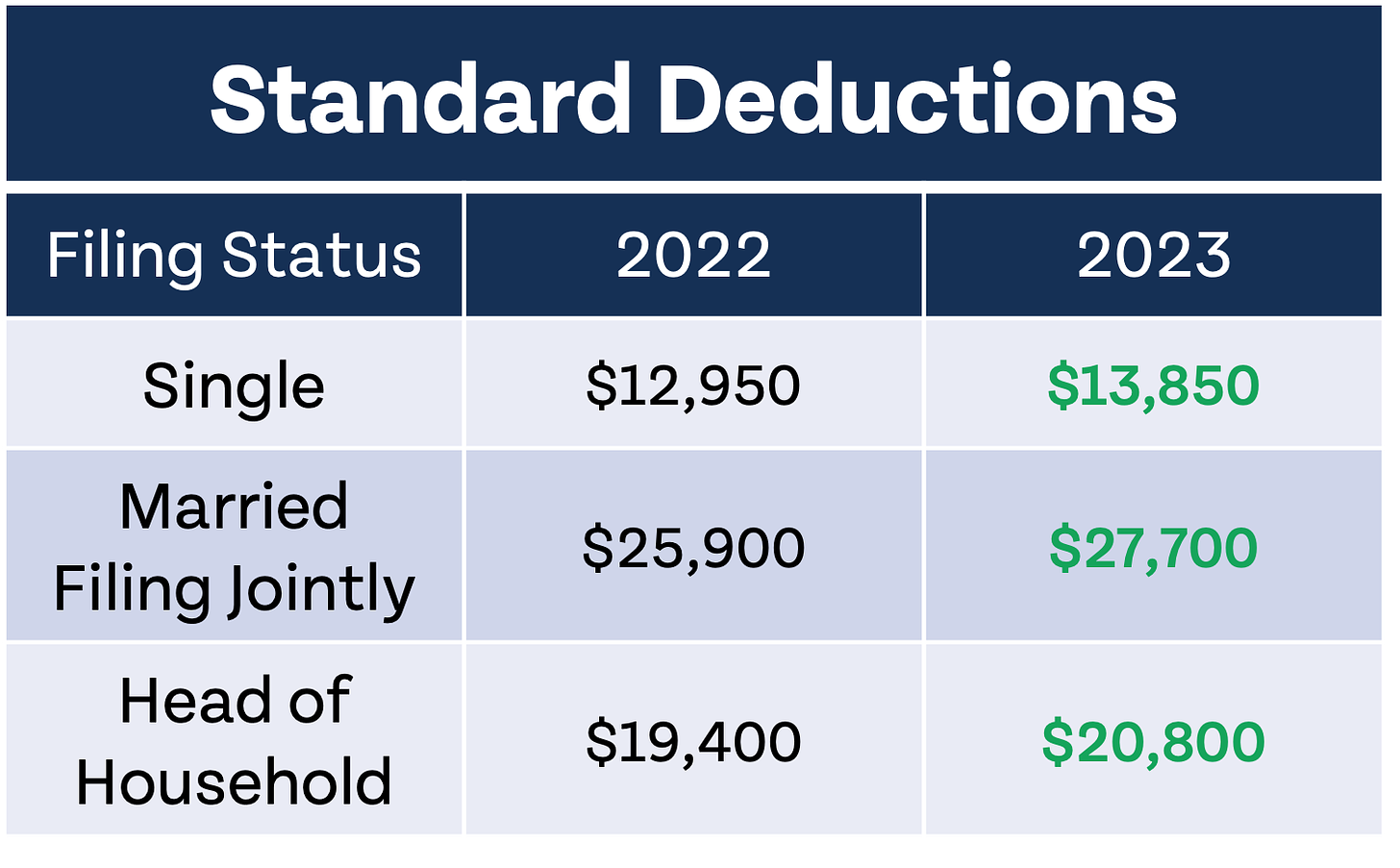

Source: moneyguy.com

Source: moneyguy.com

The IRS Just Announced 2023 Tax Changes! Money Guy, Changing to two income tax rates: Currently, there are seven different income tax rates:

Source: www.mysmartmove.com

Source: www.mysmartmove.com

4 Things Landlords Should Know to Big Save At Tax Season SmartMove, New tax measures, and changes to existing ones, will begin affecting canadians in 2024. The tax proposals of project 2025, if enacted, would likely affect every adult in the u.s.

Source: warrenaverett.com

Source: warrenaverett.com

2018 YearEnd Planning with Tax Reform Considerations Warren Averett, Changing to two income tax rates: How would the capital gains tax change under biden’s fy 2025 budget proposal?

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

What tax changes did the Affordable Care Act make? Tax Policy Center, New tax measures, and changes to existing ones, will begin affecting canadians in 2024. See current federal tax brackets and rates based on your income and filing status.

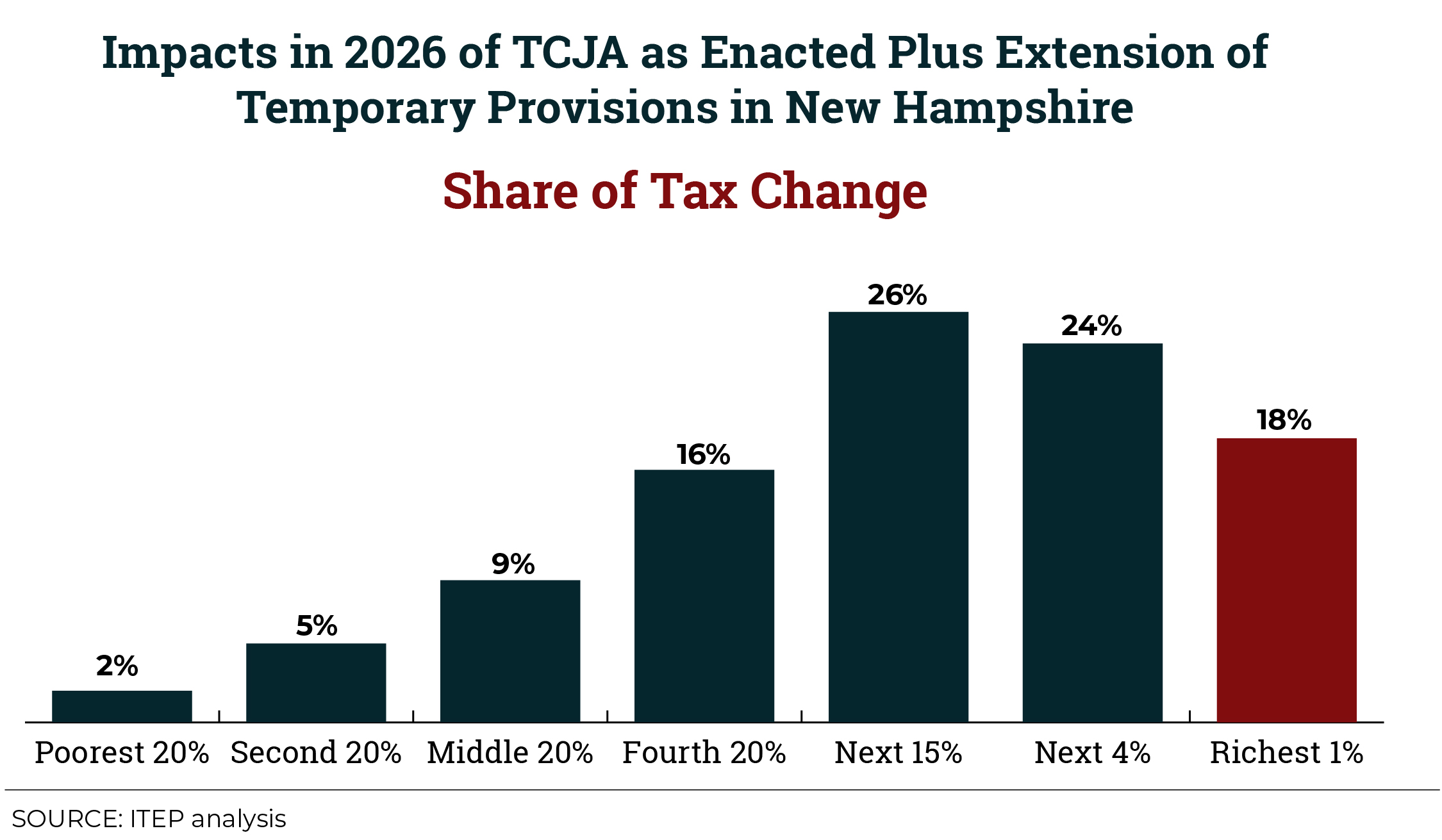

Source: itep.org

Source: itep.org

Tax Cuts 2.0 New Hampshire ITEP, Currently, there are seven different income tax rates: The sunset of key tax cut provisions by the end of 2025 heralds significant changes for taxpayers.

Unless Congress Decides To Act, Lots Of Tax Changes Will Take Effect In 2026, Including Higher Tax Rates And Lower.

10%, 12%, 22%, 24%, 32%, 35%, and 37%.

If You Are 65 Or Older And Blind, The Extra Standard Deduction For 2024 Is $3,900 If You Are Single Or Filing As Head Of Household.

Tax reform would take place in two stages.

Posted in 2025